The Ethereum merge is currently a hot topic in the circles with a lot of attention. But as the Ethereum merger date approaches, there are a lot of voices that Ethereum is going to have a hard fork.

Everyone now is talking about the possibility of a new chain and a new ETHPOW Token being created when the Ethereum merge takes place.

So this is a problem. Is it really possible to want to continue POW blocks on the Ethereum 1.0 chain after the merger? Is it necessary? Is there value?

Today, we will have a look at what the trading platforms, projects, and KOLs have to say about the blockchain.

ETHPoS Faction (anti-fork)

The opposition inside does not support the forked version of Ethereum blockchain, and only wants the existence of a new Proof-of-Stake (PoS) consensus layer.

1. Chainlink: will not support PoW ETH.

The oracle provider Chainlink has denounced plans for Ethereum forks and said that “The Chainlink protocol and its services will remain operational on the Ethereum blockchain during and after the Merge to the PoS consensus layer. Users should be aware that forked versions of the Ethereum blockchain, including PoW forks, will not be supported by the Chainlink protocol. This is aligned with both the Ethereum Foundation’s and broader Ethereum community’s decision, achieved via social consensus, to upgrade the Ethereum blockchain to PoS consensus.” The company wrote in a blog post that the rationale is consistent with the upgrade of the Ethereum blockchain to PoS consensus, because decentralized applications in the Proof-of-Work (PoW) consensus layer of the Ethereum blockchain may have difficulty scaling and operating properly without the support of a mature oracle provider.

2. Frax Finance: Launching a proposal abandoning PoW Eth Forks

Sam Kazemian, the Frax Finance co-founder, has launched a proposal in the community to oppose hard forks of Ethereum. The proposal calls for Frax DAO to choose the merged PoS Ethereum as the only recognized Ethereum network by the algorithmic stablecoin FRAX.

He has said, “FRAX is the fifth largest stablecoin in the market, accounting for over 20% of the TVL of the Curve platform, it is a Uniswap top 10 token, and a critical part of the Ethereum ecosystem. As such, it makes sense to clearly and publicly communicate the desire of FXS holders through a governance mechanism.”

3. Vitalik Buterin: People making $ETH forks are just trying to make a quick buck

Last week, Vitalik Buterinat the BUIDL Asia event in Korea said that centralized stablecoins like Circle’s USDC have the potential to become “significant deciders” in future “contentious” hard forks. Now that Frax Finance has started to take a stand, we expect other stablecoins to take a stand. He also said that “people making $ETH forks are just trying to make a quick buck.”

4. Curve Finance: Choosing a chain chosen by stablecoins

Meanwhile, Curve Finance said that for Curve DAO, it is impossible to force the choice of one or another (too decentralized). Fork will inevitably clone DAO and CRV, however only a chain chosen by stablecoins will be viable for DAO.

5. Crypto Pragmatist: I think it’s quite unlikely that we see any acceptance of a PoW fork at all. It’s just logistically unlikely.

Jack Niewold, the founder of Crypto Pragmatist, tweeted that Discounting the stablecoin problem we mentioned earlier, the PoW fork will be a ghost town. So there’d be no developer activity, no speculation, no media coverage, no way to sell your assets for ‘real world’ fiat money. Social consensus is that the merged chain is the ‘real’ Ethereum. But hypothetically, a few big players could cause a decent amount of chaos if they wanted to. He discusses the forking risk of Ethereum, calling it a “civil war” of Ethereum.

Similar to Vitalik Buterin’s view, Jack Niewold believes that forks of Ethereum could depend on stablecoin issuers like USDT (Tether) or USDC (Circle). But Jack Niewold has concerns about the potential stance of stablecoin issuers towards hard forks of Ethereum. After all, for stablecoin issuers, They could short the PoS Ethereum token, for example, announce redemptions on the PoW network, and make billions. It would effectively destroy the new network, causing loans to get liquidated, taking down protocols, exchanges, treasuries, and more.

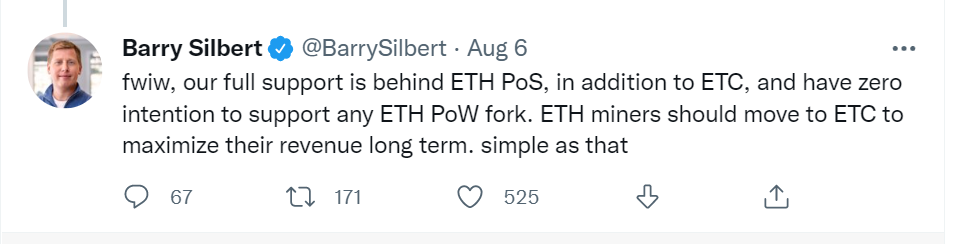

6. DCG: Not supporting any Ethereum PoW forks, miners should move to ETC

Barry Silbert, CEO of DCG, said in a discussion on his social media site about the Ethereum fork,”We full support is behind ETH PoS, in addition to ETC, and have zero intention to support any ETH PoW fork. ETH miners should move to ETC to maximize their revenue long term.” (DCG has invested in ETC).

7. Paradigm: No one in the Eth community apart from miners want to stay on proof of work

Hasu, the researcher of Paradigm, said that “If anything goes wrong with the merge, it just gets delayed until the problems are fixed and then the merge happens a few weeks later. A lot of hashpower does not give this chain any significant value. No one in the eth community apart from miners want to stay on proof of work. This fork chain will be a giant retail trap. miners, exchanges, traders are all trying to talk it up for their own self-interested reasons.”

8. Tether:Officially confirms support behind Ethereum’s merge

Tether plans to support ETH2 and will support POS Ethereum in line with the official schedule. This is not about preference for POW or POS and stablecoins should take responsibility to avoid disruptions to users.

9. Circle: Circle will “fully and solely support the Ethereum proof-of-stake chain post-merge

Circle, the provider of stablecoins, issued an announcement saying that “We understand the responsibility we have for the Ethereum ecosystem and businesses, developers and end users that depend on USDC, and we intend to do the right thing.” The company’s stablecoin, USDC, is currently the second largest with a market cap of $54.2 billion.

10. Argent: We have no plans to support any forks

Smart contract wallet Argent said it recently received some questions about a potential PoW fork after the merger. Argent is very excited about the Ethereum merger, especially the 99% savings in energy consumption. Argent said it has no plans to support any forks.

11. DeBank:Our team will NOT support any services for these potential forked chains afterwards

A hard fork would bring a big disaster for the entire Web3 ecosystem. Therefore Debank and their products will not support any services for these potential forked chains during Ethereum’s PoS merge transition, including the Web3 user platform DeBankDeFi, the Non-custodial wallet Rabby and the Web3 developer service DeBankOpen API.

12. Aave: Only consider as Ethereum mainnet, the post-merge Ethereum Proof-of-Stake

Given the lack of functioning oracles and liquidity issues on both centralized and decentralized assets, the Aave system will not work properly on any potential Proof-of-Work fork. The Aave decentralized UI should only consider as Ethereum mainnet, the post-merge Ethereum Proof-of-Stake. If any user decides to interact directly with Aave smart contracts on any fork, should be under their own responsibility.

13. FTX:Ethereum futures and perpetual contracts on FTX will track the proof of stake in Ethereum after the Merge

FTX does not have any plans to halt or settle ETH futures prior to the Merge, and they will do their best to support continuous trading. Ethereum futures and perpetual contracts (ETH-0930, ETH-1230, ETH-PERP) on FTX will track the proof of stake in Ethereum after the Merge.

14. ETC Cooperative: The new chain will be pretty useless to existing ETH users

He thought that an Ethereum POW fork won’t work, and will be an awfully hard thing even to do. The Merge is only weeks away. It is so late to do anything. So the new chain will be pretty useless to existing ETH users. The more likely scenario for big name projects is that they would explicitly choose to shut down their smart contracts on the new chain – to avoid confusion and loss to end-users. ETH miners should move to ETC to maximize their revenue long term.

15. Deribit: All instruments will take place on the ETH Proof-of-Stake (PoS) or ETH 2 chain

The official statement claims that the Deribit settlement for all instruments will take place on the ETH Proof-of-Stake (PoS) or ETH 2 chain, which is backed by the ETH foundation. Deribit will award users with this/these forked token(s) if the forked token’s value exceeds 0.25% of ETH PoS and the new chain is stable and working normally. The newly introduced token (if any) will not count as margin.

ETHPoW Faction(support forks)

1. Gate:We support $ETH potential hard fork and enable ETHS and ETHW trading

Gate is one of exchanges that are currently publicly supporting the Ethereum forks. According to the announcement on its website, ETH holders on Gate.io can go to the Swap Page to swap their ETH into two “potential forked” tokens, ETHS and ETHW at a 1:1 ratio from August 9 to the success of the ETH 2.0 upgrade. ETHS (ETHPoS) represents the token for the new PoS (proof-of-stake) chain. ETHW (ETHPoW) represents the token for the PoW (proof-of-work) chain that will potentially continue to exist.

But if the hard fork ends up failing, The ETH symbol will be retained. ETHS and ETHW will be delisted all together.

2. Tron: Full support to ETH’s potential hard fork and list forked tokens of futures

Tron announced on its official website that it “Poloniex will give full support to ETH’s upgrade and its potential hard fork. If successful, the Merge could create two parallel blockchains after the upgrade. All Ethereum (ETH) holders on Poloniex will receive the forked assets at a 1:1 ratio when the upgrade is completed.”

3.OKX: OKX to support Ethereum’s merge and if a new forked token is generated, it will have to be reviewed by OKX before it can be listed

Jay Hao, CEO of OKX, tweeted, “we actively monitor and will support the Ethereum Merge. Potential Ethereum hard forks may emerge when the network’s upgrade takes effect. We will evaluate and list the newly forked coins if there is sufficient demand.”

4.f2pool: Let the miner community decide and continue to provide mining pools to ETH PoW

Ether miners are the unsung heroes of the Ether ecosystem. Whether to support the Ether fork or not is no longer important. They will let the miner community decide. However, they will continue to provide mining pools to ETH PoW.

5.MEXC:Full support to ETH’s upgrade and its potential hard fork

MEXC full supports to ETH’s upgrade and its potential hard fork. All Ethereum (ETH) holders on MEXC will receive the forked assets at a 1:1 ratio when the upgrade is completed.

6.BitMEX: Listing an ETHPoW on August 9

Although the ETHPoW chain may have many technical challenges and its long term viability is in question, its existence may provide an exciting opportunity for traders and speculators in the short to medium term.

In a blog post, the company wrote that BitMEX announced plans to list an ETHPoW with USDT as margin, called ETHPoWZ22, on August 9.

“Just a few days ago in ETHPoW vs ETH2, the BitMEX Research team explored the possibility of a chain split in Ethereum that could result in a new ETH Proof of Work (PoW) coin. “

According to the official announcement, users can now long/short ETHPOW, with up to 2x leverage.

7. Guo Hongcai: I forked Ether once, I’ll fork it again

Guo Hongcai, also known as Bao Erye, a veteran player in the Chinese crypto community, recently established an ethereum fork discussion group on WeChat to support the ethereum forks. He also released the “Ethereum Fork Manifesto”’ through his personal Youtube channel, advocating that the forked ETHPOW chain should not be increased, pre-mined or modified, but should remain the original chain.

The reason for supporting forking, Bao Erye explained, “I think we should forking, we should keep the ETH miners, these are the people who have invested a lot of capital, a lot of money, a lot of time for the Ethereum ecosystem, who have worked very hard every day for their own beliefs and their own careers. Suddenly let this group of people lose their jobs or call it bankruptcy. I feel that I can’t bear it in my heart, I should let them continue to support the original Ethernet chain, the existing POW chain.

But in response, ETC sent a letter to Bao Erji on August 9, suggesting him to give up the PoW fork and arguing that miners should move to ETC.

8. Justin Sun:Proof-of-Work ‘Essential’ Part of Ethereum

Sun is angling to have the algorithmic stablecoin he designed, USDD, become the first stablecoin in the EthereumPOW ecosystem, he said on CoinDesk TV’s “First Mover.” The exchange he owns, Poloniex, has already said it will be the first to support EthereumPOW’s native currency.

Sun added that, at least to his knowledge, no other stablecoin issuers have come out in support of EthereumPOW, the blockchain he said will be left behind after the Merge.

“We all want to be the first solution when everybody uses Ethereum proof-of-work post-Merge,” he said on CoinDesk TV.

“I think decentralized stablecoins, like [Tron stablecoin] USDD, [a] decentralized U.S. dollar, is still essential to our industry because, as we all know, all the components of [decentralized finance] today it’s all decentralized … except stablecoins,” Sun said.

ETHPoS Faction(Neturals)

HuoB: list post-merge Ethereum forks that meet its security requirements

Crypto exchange Huobi said it will list any hard forks of Ethereum following the network’s planned switch to proof-of-stake (PoS) consensus — so long as they meet five requirements.

“As long as the forked assets meet our security requirements, we will take the first move to support users to hold the assets and earn rewards,” Huobi wrote in a blog post on Friday.

“Trading services for those coins under the spotlight will be available as soon as possible per our rules after we get an overall picture of users’ opinions.”

Still do not know what faction to choose

In general, Justin Sun, Guo Hongcai and others directly or indirectly support the forked version of Ethereum, POW blockchain, and launch the Hackathon on the PoW ecosystem. While Paolo Ardoino, CTO of Tether, Barry Silbert, CEO of DCG, Hasu and others explicitly support ETHPOS.

In addition to that there are some silent people.

For example, currently ETH mining pools such as Ethermine, Hiveon and 2Miners, as well as the top CEXs and Coinbase have not yet expressed their opinions on the matter.

Perhaps they are also struggling? Or don’t think it’s advisable to take a stand too early?

What do you think about the ETH fork? Welcome to discuss in the comment below.

Source:https://mp.weixin.qq.com/s/YXMTcY7Ge5om7fB1IaGVUA

This is a community post written by Stephen Josh and published on https://news.kcc.io