Klein Finance is a decentralized exchange of liquidity pools on KuCoin Community Chain. It features high efficient and low-risk stablecoin trading, providing liquidity providers with extra income. Users can trade, provide liquidity and get rewards in a secure and stable on-chain environment with low slippage, good depth, and low fees.

What is Klein Finance?

Klein Finance is a decentralized exchange that provides liquidity and trades with KRC-20 tokens on the KuCoin Community Chain. It is a safe and efficient decentralized trading platform for digital assets aiming to make digital assets safe and stable in an on-chain environment with low slippage, good depth, and low transaction fees.

Also, Klein allows users to stake their LP tokens to gain yield farming rewards. The trading model is a mixed liquidity pool, which provides a cross-market mechanism for creating stablecoins trading pools, which can meet the requirements of multiple stablecoins vs. non-stablecoins and multiple non-stablecoins vs. multiple non-stable tokens.

Klein Finance provides liquidity pools to the market and rewards users who provide liquidity (also known as liquidity providers). Klein Finance charges a small fee for each transaction, and a part of the collected fee is shared equally by all liquidity providers.

How Does Klein Finance Work?

Klein Finance provides a mechanism to create cross-markets for stablecoins in what could be called “Uniswap with Leverage”. Its immutability allows most of the liquidity to be concentrated around the price of 1.0 (or any real price), and this is a very useful feature for creating liquidity between stablecoins.

The AMM with the dynamic pegging method creates liquidity for assets that aren’t necessarily pegged to each other in a way more efficient than the m · n = λ invariant. This creates more than 5 – 10 more liquidity than Uniswap and provides higher profits for liquidity providers.

So, what problems does Klein Finance solve:

- It inherits the advantages of StableSwap’s ultra-low slip point and aggregation liquidity near the “equilibrium point”.

- By fitting between the constant product curve and the StableSwap curve and to the constant product curve in the middle and tail area of the curve, the advantage of the constant product curve in rapid response to liquidity changes is obtained, to avoid the depletion of pool liquidity and respond flexibly to rapid market changes.

What Is the KEN Token?

KEN is a non-stable equity token in the Klein Finance protocol. The supply of KEN is initially set at 100 million, which will be the entire limited supply of KEN, but deflation may occur depending on market conditions. The overarching principle of its design is to add the ability to capture value for KEN. According to the circulation of KEN in the protocol, the following design requirements need to be met:

- Realize the function of regulating and stabilizing liquidity.

- Balance the benefit of users, LPs, and governors.

- As a transaction fee in each protocol.

The purpose of issuing veKEN governance tokens is to separate the governance rights and voting rights of the protocol from other rights to better meet the governance needs, and to achieve the long-term development of the protocol through a reasonable governance solution.

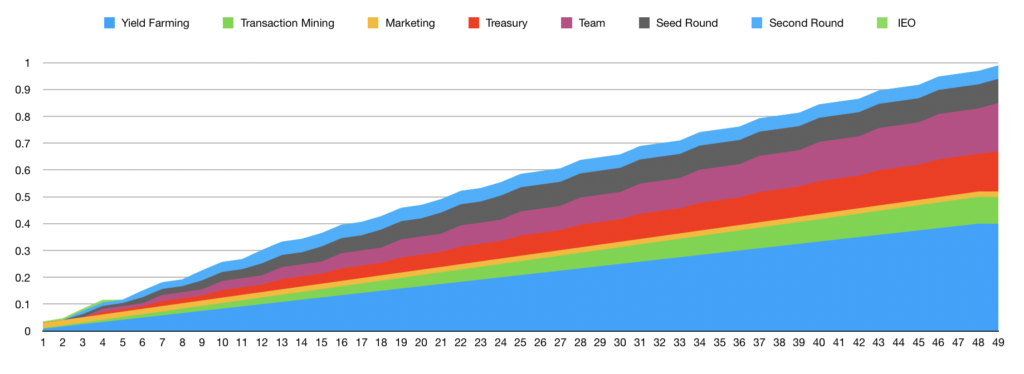

| Amount | Release Period | Explanations | |

| Yield Farming | 40% | About 4 to 10 years of distribution | |

| Transaction Mining (motivate market makers) | 10% | 15% about 4 to 10 years of distribution | Most of the selling pressure comes from this segment 40% of this segment requires staking veToken acceleration to get it |

| Marketing | 2% | One-time unlock | For project market making |

| Treasury(Rise Reserve) | 15% | do not distribute if not necessary | |

| Team | 18% | About 2 to 4 years of distribution | Released by mining or monthly |

| Fundraising | 15% | About 1 to 2 years of distribution | Distributed monthly or quarterly |

Closing Thoughts

The development path of Klein Finance and AMM is very different from Uniswap V3. Uniswap V3 provides liquidity providers maximum flexibility. Liquidity providers can choose a price range in which to provide liquidity.

Unlike Uniswap V3, the project’s AMM mode can automatically adjust the liquidity aggregation range based on the feed price of the internal Oracle, without requiring liquidity providers to redeploy the liquidity range. This design is more friendly to individual investors and does not require liquidity providers to formulate complex market-making strategies.

In general, Klein Finance still has obvious competitive advantages in the field of stable asset trading, but in the field of unstable asset trading, the AMM of the dynamic peg mode is still in the process of exploration.

DISCLAIMER: Please note that all projects and dApp applications running on the KuCoin Community Chain (KCC) are independently developed by third-party developers. They are not audited by KCC official team. KuCoin Community Chain is an entirely open-source and open community, which means everyone and all project parties can participate. All opportunities and risks also exist at the same time. You need to identify and prevent risks carefully.